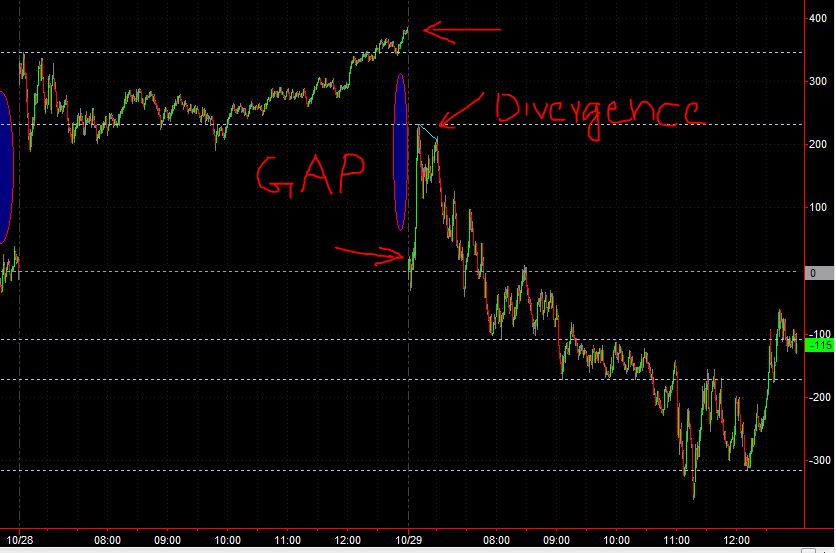

Watching how the Spreads open relative to the previous day will provide an idea about the overall strength of the market. Here is an example from 10/29/2014.

On Oct 29 S&P Spreads Opened GAP down compared to Oct 28 2014. BUT futures opened at the close of Oct 28th. This pointed to weakness at the open.

Futures eventually moved higher in strong volume. Observe the divergence in Spreads during the peak in ES. To make it more probable, the divergence also existed in NQ as NQ did not make higher high..

Given the overall weakness in the market as Spreads not agreeing with the highs, look for Strategies to short the market. On 29th , there where multiple opportunities to short the market ( strategy H, I ).